Payroll, elevated

Meet tax and compliance regulations without the headache of doing it yourself.

Payroll Services

Payroll, while an essential component of your business, is a time-consuming and detail filled task that requires a deep understanding of your local tax and compliance regulations.

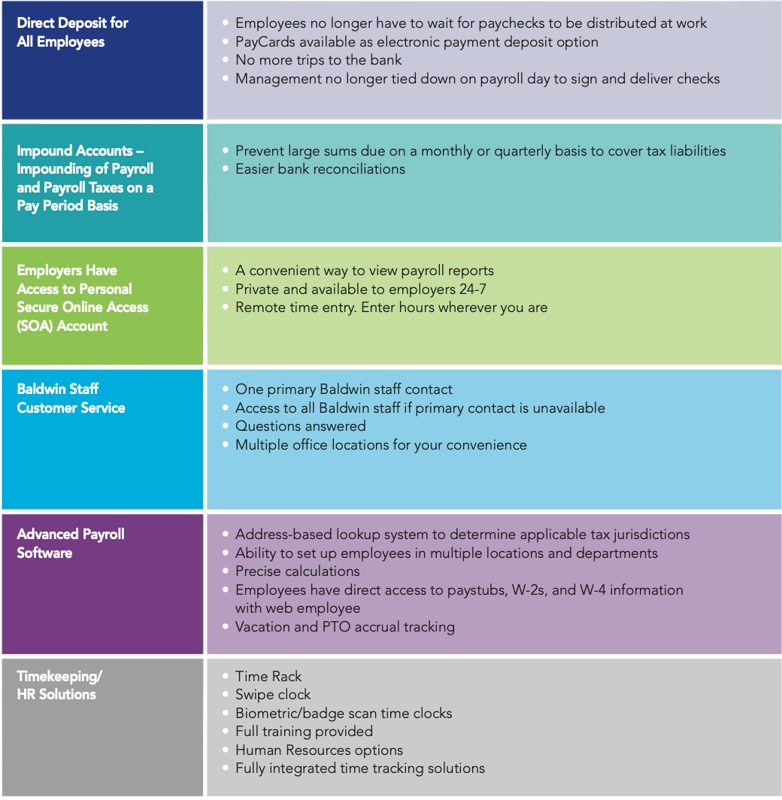

The Baldwin Elevate team provides services that span the spectrum of your payroll functions and are designed to automate your operations and ensure compliance.

The best part? You no longer have to manually process payroll or write checks.

Our Services

-

Direct Deposit

-

Impound Payroll Taxes

-

Employee Web Access

-

Time Tracking

-

Monthly Returns

-

Quarterly Returns

-

W-2 Preparation

-

Certified Payroll Reports

-

Contract labor ACH Payments

-

HSA Direct Deposit

-

401K Deposits

-

Cafeteria Plan Setup

-

Garnishment Calculations

and Payment -

Fringe Payments

-

Tipped Wage Reporting

-

Accrued Benefit Tracking

-

Tax and Audit Support

Access Web Payroll

For current clients and employees. 24/7 Access

Fully-automated and tax-compliant software that lets you focus on your business.

Let's Connect

Submit an interest form or request a meeting to learn more about what we can do for your business.

Insights

2 min read

Navigating 1099 Season: What Businesses Need to Know

Baldwin CPAs: Dec 1, 2025

1 min read

Proactive Planning: Empowering Individuals and Business Owners

Baldwin CPAs: Nov 24, 2025