Preparing for 2026 Reimbursement & Regulatory Shifts: What Independent Practices Need to Know Now

Independent medical practices are facing a challenging, but navigable, future. From downward pressure on reimbursements to rising staffing costs and...

Late fall 2022 HRSA released an updated reporting requirements policy with regard to Provider Relief Fund and American Rescue Plan Rural Distribution. The updated policy seeks to amend previously established requirements released in June 2021. Understanding these changes and how they impact specific healthcare organizations is imperative to the financial health of the practice.

Key Changes

An important update was made regarding use of funds, including allowing recipients of PRF and ARP Rural Distribution payments to use the funds to cover eligible expenses that were incurred prior to receipt of the funds, so long as the expenses are related to the prevention, preparation, and response to COVID-19.

Further updates were made to designate underutilized funds to cover lost revenue. Specific lost revenue calculation requirements state that lost revenue should include only revenue through the end of the quarter in which the Public Health Emergency ends. However, Nursing Home Infection Control distribution cannot be utilized to cover lost revenue. These distributions can only be used to cover expenditures related to infection control.

Additionally, entities that received ARP Rural distributions must allocate the funds to cover expenditures that are unreimbursed by other sources, including PRF payments. Furthermore, the Tax Identification Number (TIN) to receive the ARP rural distribution must also be the TIN to utilize the funds.

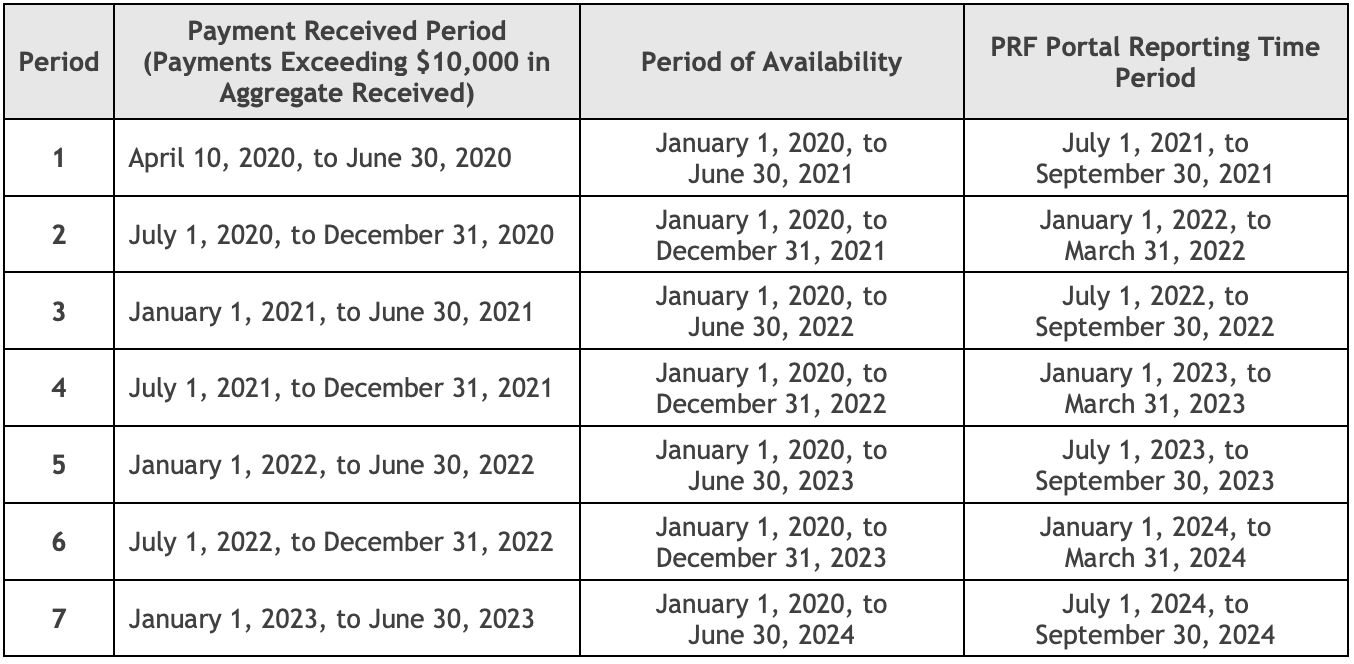

Updated reporting requirements also include Period 5, 6, and 7. Recipients who received one or more payments of $10,000 or greater during a payment received period (as outlined below) are required to report in HRSA’s PRF Reporting Portal.

For questions on the new requirements or additional help determining your organization’s liability, please reach out to our medical team.

Independent medical practices are facing a challenging, but navigable, future. From downward pressure on reimbursements to rising staffing costs and...

In today’s healthcare environment, patient retention is just as important as attracting new patients. Retaining loyal patients not only ensures a...

At the beginning of the year, the Centers for Medicare and Medicaid Services (CMS) committed to a record $49.4 million to fund a variety of...