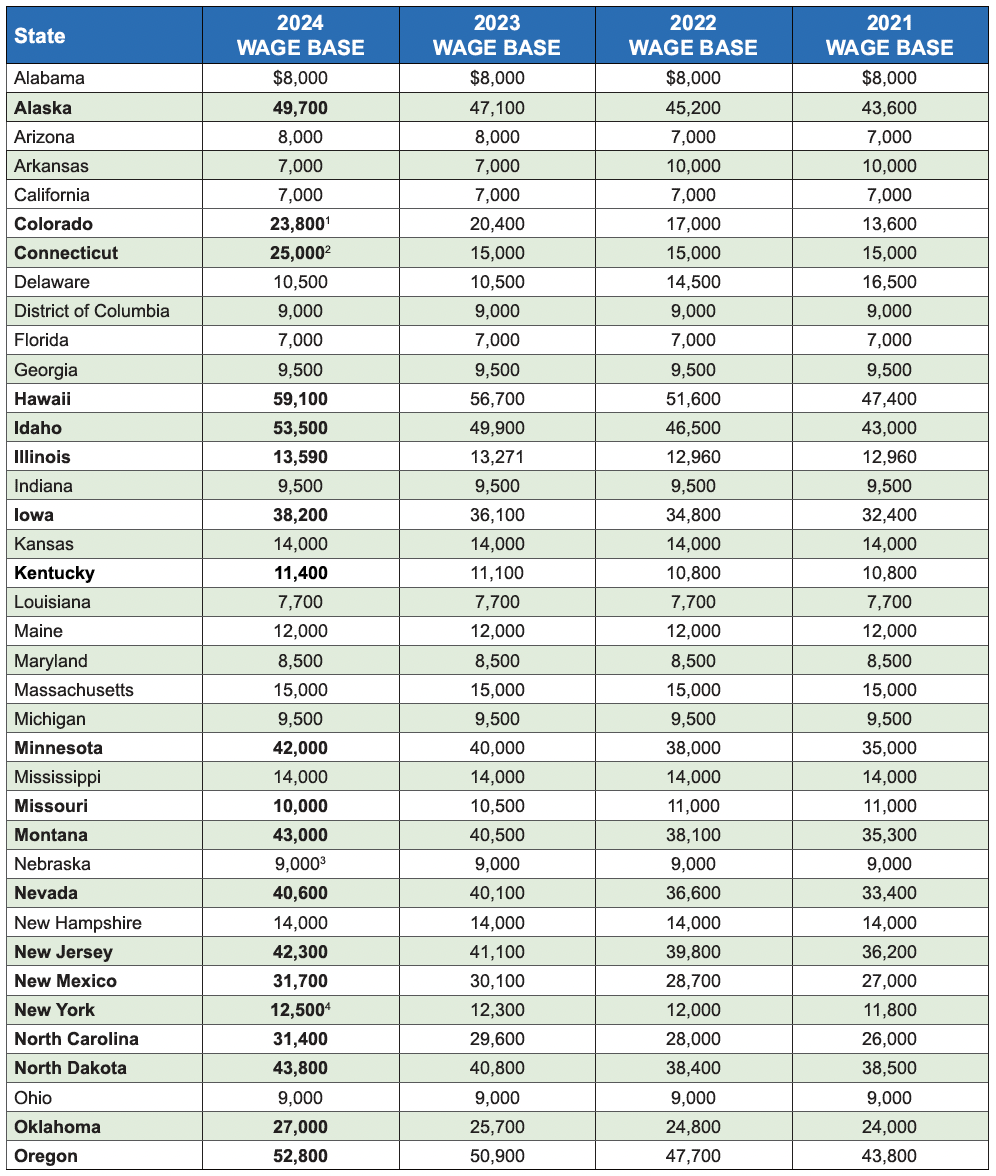

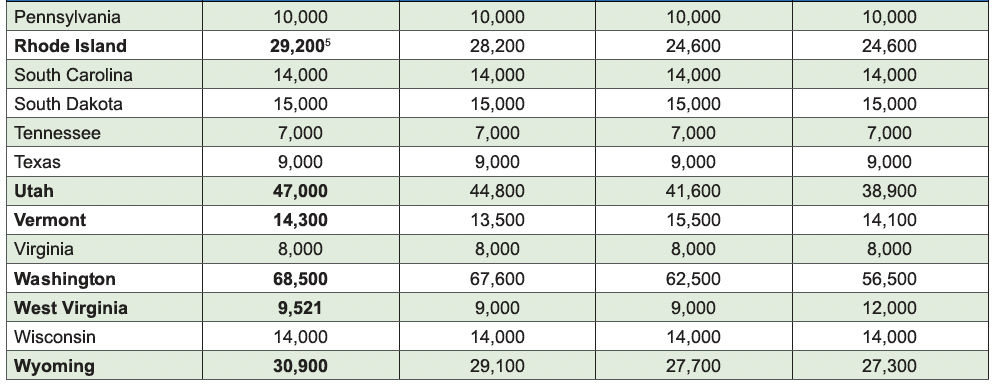

Taxable Wage Bases 2021 – 2024

State unemployment insurance taxes are based on a percentage of the taxable wages an employer pays.

The Federal Unemployment Tax Act (FUTA) requires that each state's taxable wage base must at least equal the FUTA wage base of $7,000 per employee, although most states' wage bases exceed the required amount.

Some states apply various formulas to determine the taxable wage base, others use a percentage of the state's average annual wage, and many simply follow the FUTA wage base.

See a chart of State Taxable Wage Bases for 2024, 2023, 2022, and 2021 below. States that have changed their wage base for 2024 are highlighted in bold face.